When it comes to credit cards, reward programs can significantly enhance the value you receive from everyday spending. With so many options available, finding the best reward credit card tailored to your needs is essential. This article highlights top reward credit cards that can help you earn points, miles, or cash back effectively.

Growing up, I was always warned about the dangers of credit cards and interest rates; however now as an adult I exclusively use them. I'm going to spend that money anyway, I should get something back. If you are not good at paying bills on time, credit cards might not be a good fit for you. My husband and I have a deal, we can have credit cards so long as we never pay a late fee. We've had at least one credit card for over 10 years now, and never paid a late fee.

When deciding on a credit card, we needed to evaluate our needs as a family. What did we want to earn as a reward: cashback, points, travel, did we want a sign-on bonus and what did we qualify for with our current credit score?

We decided on getting a card that would give us the most cashback. We don't travel very much and we didn't want to be limited by points on what we could purchase. Cashback worked for us, and although that doesn't always make sense for everyone; however, it did for us.

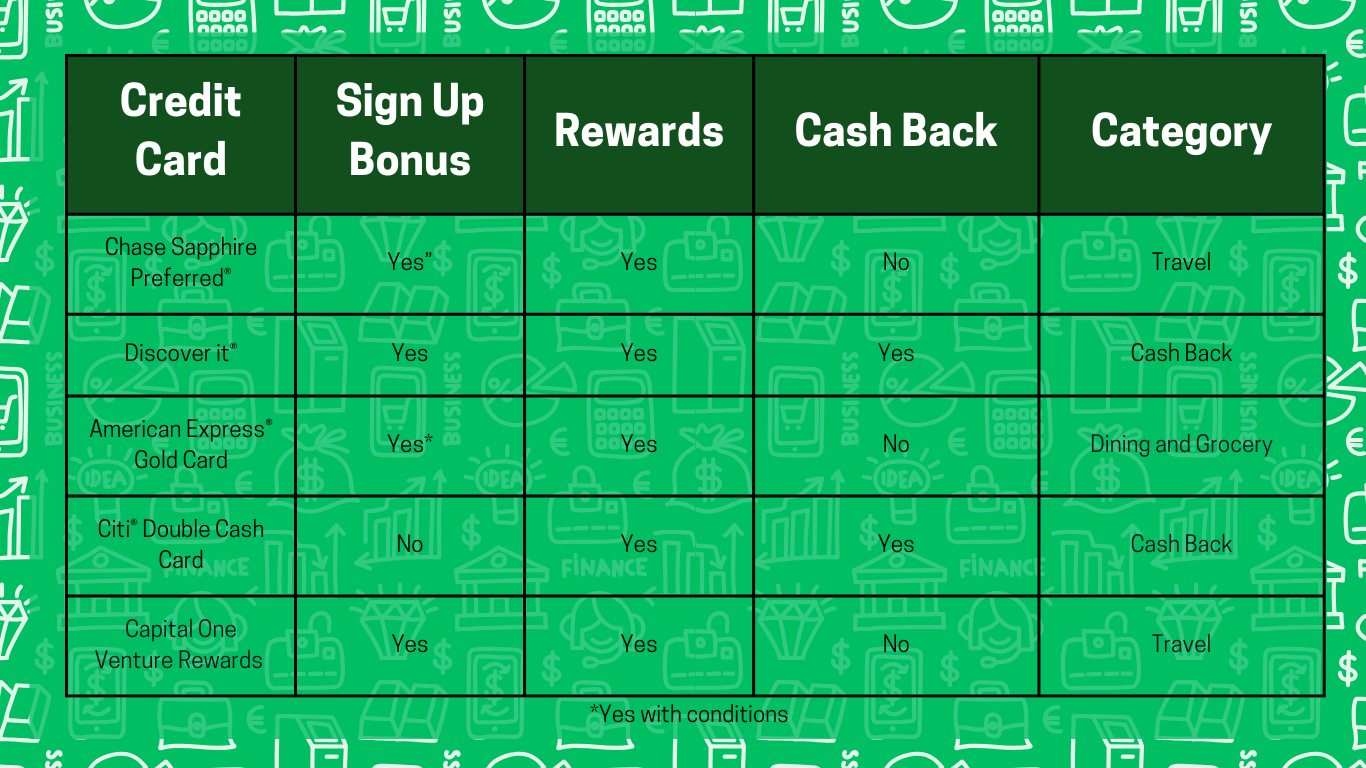

Here are 5 top credit cards including their category, sign-up bonus, and rewards. For more information keep scrolling down.

Chase Sapphire Preferred® Card

Category: Travel Rewards

Sign-Up Bonus: 60,000 points after spending $4,000 in the first 3 months

The Chase Sapphire Preferred® Card is a favorite among travel enthusiasts. It offers 2x points on travel and dining at restaurants and 1 point per dollar spent on all other purchases. Points can be redeemed for travel through the Chase Ultimate Rewards® program at a value of 1.25 cents per point.

Discover it® Cash Back

Category: Cash Back

Sign-Up Bonus: Match all cash back earned in the first year

The Discover it® Cash Back card allows you to earn 5% cash back on rotating categories each quarter, such as groceries, gas, and more, up to a quarterly maximum. Plus, you’ll earn 1% on all other purchases. The card has no annual fee and provides excellent rewards for everyday spending.

American Express® Gold Card

Category: Dining and Grocery Rewards

Sign-Up Bonus: 60,000 points after spending $4,000 in the first 6 months

American Express® Gold Card rewards users with 4x points on dining at restaurants, including takeout and delivery, and at U.S. supermarkets (up to $25,000 each year).

Citi® Double Cash Card

Category: Cash Back

Sign-Up Bonus: None, but offers 2% cash back on all purchases

The Citi® Double Cash Card provides an uncomplicated way to earn rewards. You earn 1% cash back on every purchase and an additional 1% when you pay your bill, giving you a total of 2% cash back on every transaction, with no annual fee.

Capital One Venture Rewards Credit Card

Category: Travel Rewards

Sign-Up Bonus: 60,000 miles after spending $3,000 in the first 3 months

The Capital One Venture Rewards Card is perfect for travelers, offering 2x miles on every purchase. Miles can be redeemed for travel expenses, including flights and hotel stays, making it one of the most versatile travel reward cards available.

Selecting the best reward credit card depends on your spending habits and preferences. Whether you prefer cash back, travel miles, or specific category bonuses, there is a card that fits your lifestyle. Always consider the associated fees, interest rates, and reward structures to make an informed decision. Keep in mind that maximizing rewards often involves being mindful of payment deadlines and maintaining a healthy credit score.

For more detailed information or personalized recommendations, consider consulting a financial advisor or exploring credit card comparison websites.