Beginner Budgeting While Still Saving Money

Zero-Sum Budget

When I think of budgeting I get overwhelmed. Where do I start? What kind of budget is best for my family? Do I have to do it everyday? If it is the middle of the year, do I start there or can I just start from this month?

Start with an easy budget to manage then you can move to something a little more complex. Zero Sum Budgeting is one of the easier budgeting methods. This is what we use with our family finances. The name kind of implies what you have to do. Your money, all of it, has a job – leaving a zero sum at the end of the month.

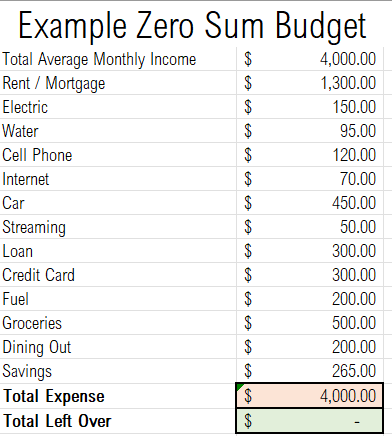

Let’s say you make $4,000 a month and after you pay all your bills for the month and you have $265.00 left (Example down below). You’re not done budgeting. A decision needs to be made about where that money is going to go. Are you planning a trip? Do you have some debts to pay off? Are you planning for the future? The point is every dollar is accounted for, and has a place to go.

The thing that I really enjoy about this type of budget is that you don’t have to do it every single day. I work on our budget about every 2 weeks or so. After you set up your budget there’s really just maintenance work after that. The set up can take a bit, but our usual amount of time working on it is about 20-30 minutes every two weeks. So, not bad at all.

Our set up did take several hours but only because we decided to start from the beginning of the year, so we had seven months to do. You do NOT have to start from the beginning of the year like us, you can start in the month that you are in. You just need to know what your average expenses are, rent/mortgage, utilities, internet, cell phones etc. and what your average income is about.

This really works well for us because currently we live off of one income that is a salary. So we know exactly how much money we will be getting every month. If this is not the case for you, I would take the high end of your every bill and if it comes in less, no harm no foul. This way you are budgeting for more just in case, and you could end up having more money for paying down debt or vacation or whatever.

The important part is that every dollar has a place that it needs to go to: savings, paying extra on debt, vacation etc.

I would like mention that we keep a set amount in our checking and don't go below that amount. This ensures that we have money in the bank and don't get charged a fee by the bank. It also allows us to pay for random things that come up, for example repairs on the, car, AC, washing machine etc. It gives us a little cushion or as we call it, breathing room.

Here is an example of what a zero-sum budget might look like for an average person. You will have zero money left over, because every dollar earned has a job to do. When we started doing this, we padded our checking account with the $265.00 until we got to an amount that we felt comfortable. Then we padded our savings, then started paying extra on debt.

This is just how we personally did it. It does not mean you have to or should do it the exact some way we did. This budgeting system has helped us a lot, now that we are in the paying extra debt off phase, we are actually seeing our account go up since we have paid some things off early.

This is just one of many different types of budgeting styles, make sure that you find one that best fits your needs.